Wealth Management

Wealth Management services are more than just monitoring a collection of accounts.

They're a symphony of carefully arranged components that work in harmony to help produce a sound financial future.

Investments

Insurance

Tax Planning

Estate Planning

Investments

- Create tailored strategies to align with your goals and risk tolerance.

- Balance growth opportunities and risk management.

- Adapt portfolios to your evolving financial needs.

- Integrate investments into your comprehensive financial plan.

Insurance

- Review current insurance coverage to identify gaps.

- Recommend strategies to enhance financial confidence.

- Collaborate with specialists to ensure proper coverage.

- Align protection solutions with your long-term objectives.

Tax Planning

- Work with your accountant to identify tax optimization strategies.

- Coordinate investment decisions to potentially minimize tax liabilities.

- Help integrate tax considerations across your financial plan.

- Provide a holistic view of how taxes affect your wealth strategy.

Estate Planning

- Collaborate with your attorney to align plans with your goals.

- Ensure wealth transfer strategies reflect your wishes.

- Integrate your estate plan with your broader financial strategy.

- Focus on leaving a meaningful, well-organized legacy.

The CFP® Advantage: Expertise You Can Trust

Discover how working with a CFP® professional can help you achieve your financial goals with confidence and clarity. Our advisors bring expertise, integrity, and fiduciary responsibility to guide you through every financial decision. Learn how we can make a lasting difference in your financial journey.

What It Costs to Hire a Wealth Manager

Understanding the cost of hiring a wealth management professional is essential to planning your financial future. With a focus on cost transparency, we provide a clear, competitive fee structure so you know exactly what you're paying for. Let us show you how we deliver value at every step.

Our Service Method

Here's what you can expect if you work with us.

Step One

Schedule an Appointment with Scott and Justin

- Call, text, or Email Emily to Schedule an initial 30 min. call with Justin or Scott

- One of our advisors will take the time to learn about your situation and if Campbell Wealth Management is the right fit for you.

- If you aren't the right fit Scott and Justin will do their best to send you in the right direction.

- If the advisors think you are a good fit for the Firm, Emily will get you scheduled for an in person Discovery meeting.

Note: If you have been referred by a current client Emily will schedule you directly for an in Person appointment

Step Two

Drinks, Puppies, and good conversation...

First, and most importantly, when you walk in the door, meet the team! Kyro(left) and Koda(right) can sniff a bad client from a mile away!! So be on your best behavior! After meeting our star employees, grab a coffee or water and come take a seat!

Discovery and Goal Setting: Once you are settled in, Scott and Justin will spend the next 1-2 hours to...

- Learn about you, your family, and your current situation.

- Have an in-depth conversation to explore:

- Lifestyle

- Risk tolerance

- Family dynamics

- Career trajectory

- Current financial situation

- Specific financial objectives

- Your expectations for an advisor

- Your thoughts about money & wealth

- Gain an understanding of your short medium and long term goals.

- Talk about fees.

- Decide if you are the right fit for Campbell Wealth Management

- Talk about next steps, schedule next appointment.

Step Three

Financial Analysis

If needed, Emily will then reach out to gather any additional information not covered in our first meeting. We then conduct a thorough analysis of your current financial situation. This includes evaluating your income, expenses, assets, liabilities, investments, insurance coverage, and tax situation.

Scott and Justin will then jointly assess your financial strengths and weaknesses, identify areas for improvement, and determine any potential risks, gaps, or opportunities that need to be addressed.

Step Four

Development of a Comprehensive Financial Plan

Based on the information gathered and analyzed, we will develop a customized, comprehensive financial plan tailored to your unique circumstances and goals. This plan strives to outline specific strategies and recommendations to seek to give you the best chance toward reaching your goals, whatever they may be. Recommendations may include elements such as:

- Budgeting

- Tax optimization

- Risk management

- Debt management

- Retirement planning

- investment strategies

- Estate planning, and more...

We ensure that all aspects of your financial life are considered and integrated into the plan.

Step Five

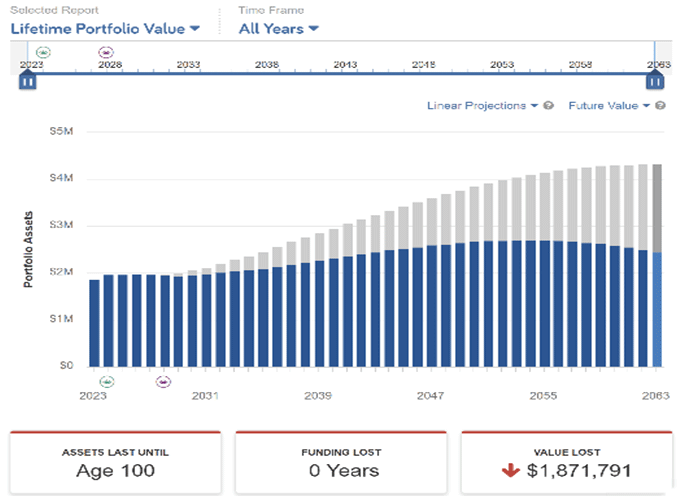

Presentation of the Financial Plan

Once your plan is fully developed, we will have you back in to present your plan along with our recommendations. Using a software called WealthVision, we will walk you through different scenarios based on our previous conversations. You will see the impact of your choices in real time as your assets rise and fall depending on the choices you make.

We will then proceed to show you an itemized list of recommendations to potentially increase your chances of reaching your goals.

Step Six

Implementation

Once the financial plan is finalized, we assist you in implementing the recommended strategies.

This may involve:

- Setting up retirement plans

- Opening investment accounts

- Establishing insurance coverage

- Consolidating or refinancing debt

- Adjustments to your financial structure

Our team will guide you through the implementation process, ensuring that every step is executed effectively and efficiently.

Step Seven

Monitoring and Ongoing Review

Financial planning is not a one-time event but rather an ongoing process. We understand that your circumstances and goals will likely change over time, and external factors can influence your financial situation. Our goal is to build a long term relationship with you and your family. We want to be a constant resource that you can leverage as you progress through the many ups and downs of life.

We conduct an annual comprehensive review and will be checking in with you multiple times throughout the year.